With fewer youth and working-aged adults spread among the population, and a larger proportion of elderly Pennsylvanians, the demand on government services is expected to increase in the long run.

“The burden of support will fall on a smaller group of taxpayers,” the Independent Fiscal Office noted in a recent report on the commonwealth’s demography. “The actual contraction of the working-age cohort suggests that real per capita tax levels for that age group must increase to keep pace with the anticipated increase in demand for healthcare and other services.”

The IFO expects population growth to be flat in the near term and fall slightly in the long term. But the numbers of school-aged children are expected to fall 3.2% in the near term and 3.5% in the long-term, as are the numbers of working-age adults (2.6% near-term, 1.7% long-term).

Yet the IFO expects retirees to go up 13.4% in the near term and 3.4% in the long term, and advanced-aged Pennsylvanians (age 80 and up) to increase 8.2% in the near term and 20.8% in the long term.

“By 2030, about 35% of all older adults in the Commonwealth will be part of the retiree cohort,” the IFO report noted.

Though the state is on the positive side of net migration (with estimates of 91,000 people moving in from 2025 to 2030), it won’t make up for Pennsylvanians who pass: The IFO expects 111,000 more deaths than births during that same time.

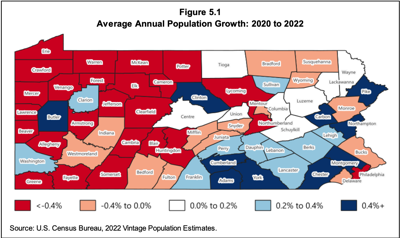

Some parts of the state may be better off than others: most population gains have gone to the southeast, while the northwestern parts of Pennsylvania have struggled to keep its population level.