(The Center Square) – Republicans in both Pennsylvania chambers of the General Assembly said Wednesday the governor’s proposal to shackle certain program funding to inflation may trigger massive tax increases in five years.

House Appropriations Minority Chairman Seth Grove, R-York, said Gov. Josh Shapiro’s plan to cut cellphone taxes and raise 911 fees rates that align with the consumer price index will, in time, erase the $124 million savings his administration projects for the coming fiscal year.

“The big question is, how long will it take the inflationary increases to actually surpass any projected savings,” Grove said. “It’s a big worry that taxpayers are going to pay more in taxes moving forward than what they’re going to get in savings this fiscal year.”

Shapiro’s $44.4 billion plan assumes inflation will rise by roughly 2% to 3% per year – keeping pace with the amount it projects expenses will increase, too.

It also depletes the state’s $5.6 billion rainy day fund to support policies that could bring in more tax revenue – such as raising the minimum wage, reducing child care costs and incentivizing graduates to pursue careers that struggle to recruit and retain workers.

“We’re prepared to weather a storm should it come and we can afford to make critical investments for the people of Pennsylvania right now,” Shapiro said during his March 7 budget address. “Investments to build an economy that works for everyone, to create safe and healthy communities, to ensure every child receives a quality education and to protect real freedom.”

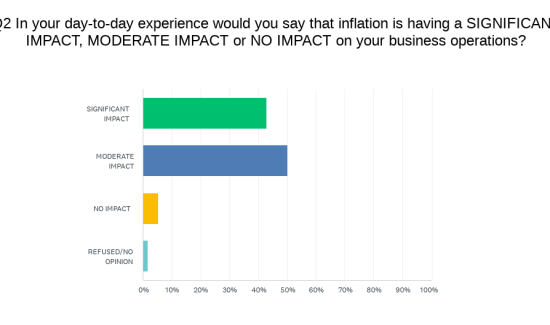

Grove said it seems unlikely, however, that the rate of inflation be much less than 6% this year, nor did he believe future proposals would keep costs increases below 2%. Instead, he said, Republicans expect future budget proposals will grow state spending between 4% and 6% each year – much like it did under former Gov. Tom Wolf.

It’s not the only program Shapiro wants to tie to inflation, either, making Republicans in both chambers worry that his projected $2.5 billion budget deficit projected for 2027 may exceed $10 billion.

“I don’t know how you fix $10 billion right at the end of the year,” Grove said. “So, those are some scary numbers.”

In November, the office released its five-year economic outlook that simulated budget spending through 2027-28. Its findings projected an average of 3.3% growth in spending and 2.6% increase in revenues, resulting in a $3.1 billion deficit.

Knittel cautioned the results assume the economy returns to “normal” prepandemic growth and no policy changes that impact expenses occur during the five-year period. He said the administration’s calculations assume a 3.1% inflation rate, though federal data published this week determined CPI increased by 6.9% in the Philadelphia-Camden-Wilmington region.

“It’s likely that the economic forecast that is being used was made a few months ago,” he said.

Grove agrees that the administration’s numbers don’t project the impact of a recession, but rather just the status quo of “clicking along, nothing bad happens.”

“It’s something that is on our minds here in the General Assembly is how we use substantial one-time surplus and rainy day funds and it’s not even raining,” he said. “So, I think we all realize that a bad economy means these numbers – it’s a bigger problem.”